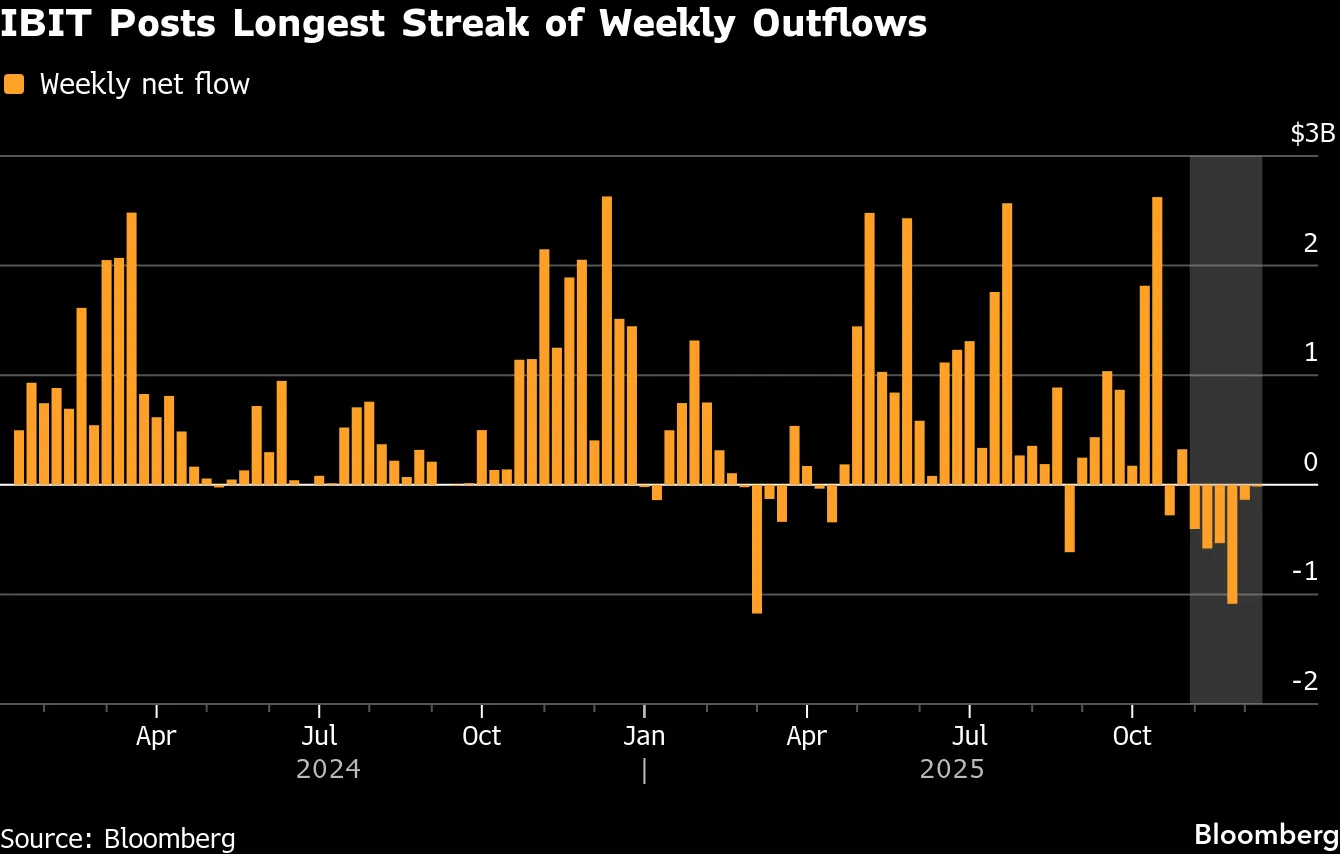

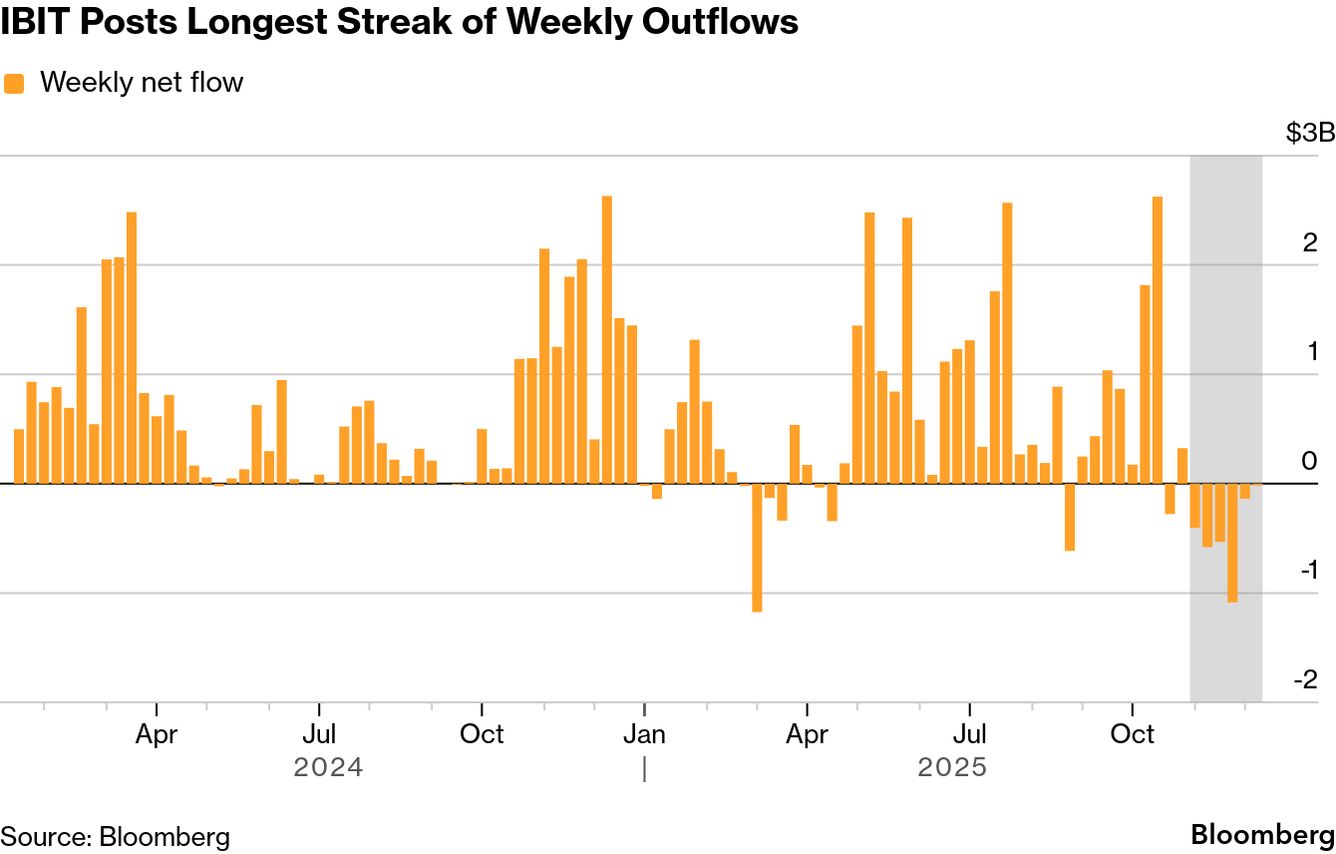

BlackRock Bitcoin ETF Sheds $2.7 Billion in Record Outflows Run

TL;DR

BlackRock's Bitcoin ETF has experienced its longest streak of weekly outflows, totaling over $2.7 billion, indicating subdued institutional interest despite recent price stabilization. This trend reflects a shift in market sentiment from earlier inflows, with Bitcoin prices down 28% from their October peak.

Tags

BlackRock Inc.’s iShares Bitcoin Trust recorded its longest streak of weekly withdrawals since debuting in January 2024, in a sign that institutional appetite for the world’s largest cryptocurrency remains subdued even as prices stabilize.

Investors yanked more than $2.7 billion from the exchange-traded fund over the five weeks to Nov. 28, according to data compiled by Bloomberg. With an additional $113 million of redemptions on Thursday, the ETF is now on pace for a sixth straight week of net outflows.

The IBIT fund oversees more than $71 billion in assets and has served as the flagship vehicle for traditional investors seeking exposure to Bitcoin. The sustained period of outflows aligns with Bitcoin’s slide into a bear market following a severe liquidation event in early October, which kicked off a more than $1 trillion wipeout in crypto market value.

Read more: Crypto’s Brutal Month Triggers a Stress Test for Wall Street

BlackRock didn’t immediately respond to a request for comment.

While Bitcoin has recovered some ground this week, the sustained ETF outflows highlight how sentiment has shifted in a market long dominated by momentum.

The trend “marks a clear reversal from the persistent inflow regime that supported price earlier in the year, and reflects a cooling of new capital allocation into the asset,” blockchain analytics firm Glassnode said in a recent note.

Bitcoin fell about 1% to $90,967 as of 10:47 a.m. in New York on Friday, down 28% from its peak in October.